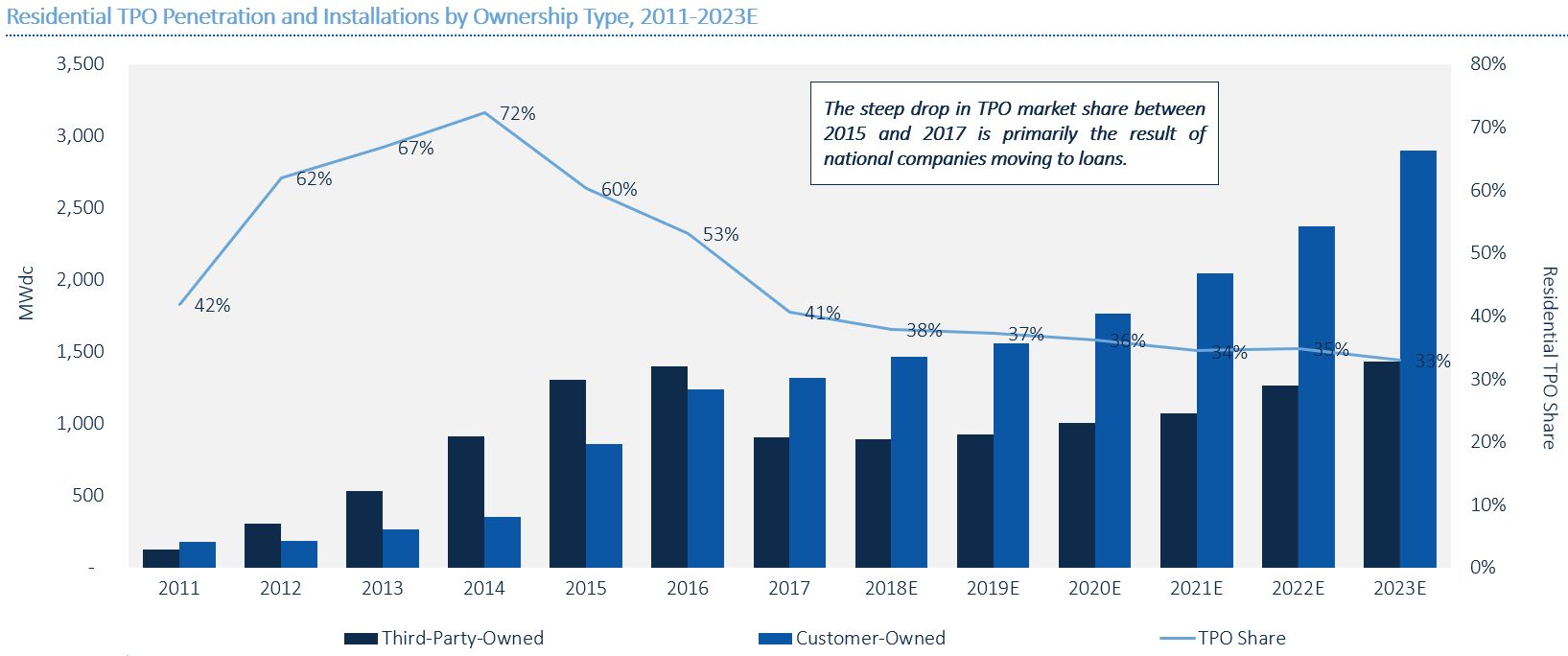

According to a new report from GTM Research, U.S. Residential Solar Finance: H1 2018, 2017 was the first year since 2011 when more home systems were purchased with cash and loans (59 percent) than with leases and PPAs (41 percent). This trend runs opposite to what GTM Research is seeing in the commercial sector.

Allison Mond, GTM Research senior solar analyst, attributes the decline of third-party ownership to three key reasons: the widespread availability of loan products, a shortage of third-party ownership (TPO) suppliers, and Tesla's and Vivint’s deliberate move away from TPO.

According to the report, the share of TPO in the market is expected to drop to 33 percent by 2023 as growth expectations for the long tail of installers exceed those of top TPO providers. This TPO percentage is higher than previously forecasted, as new information suggests a rebound in volume for major TPO providers, as well as the likely entry of new TPO providers to the market.

Source: U.S. Residential Solar Finance: H1 2018

Shifting rankings

Sunrun surpassed Tesla as the No. 1 TPO provider in 2017, while Sunrun finished the year with 32 percent market share of the TPO market. This compares to 23 percent for Tesla and 16 percent for Vivint Solar, both of whom struggled to grow and are pivoting away from TPO sales. Sunrun has grown because it is both a vertically integrated installer and a financier supplying the long tail of residential installers.

As the popularity of solar loans grows, Mosaic has emerged as a top player and claimed the No. 1 residential financier spot in 2017, just edging out Sunrun. According to the report, Mosaic’s impressive 14 percent market share of financiers can be attributed to its supply of solar loans to Tesla, as well as its work with more than 150 other leading solar installers. Sunlight Financial has also grown significantly in 2017, thanks in large part to its relationship with a few large installers, while Dividend Solar has experienced growth due to its ability to work with relatively small and nascent installers.

Competition in the solar loan space intensifies

Many solar-specific loan providers, as well as traditional banks and credit unions, have recently entered the space. Mond notes that this intense competition has led to very competitive rates — and therefore compressed margins — leaving questions about the financial health and long-term viability of many of these loan providers. While some lenders are primarily focused on growth and market share, others are scaling back growth expectations in order to pursue more profitable sales.

Many solar lenders are expanding into additional verticals such as storage and home improvement to boost margins. GTM Research also expects increased adoption of O&M by the end of 2018 after first-movers bring awareness of the product to consumers and other lenders become eager to match the competition’s offerings.

According to Mond, 2017 was a record year for solar securitizations, with more than $1.4 billion in issuances (up from a cumulative $795 million prior to 2017). "Mosaic, Sunnova and Dividend Finance all issued securitizations for the first time, and the diversity in sponsors and products indicates an increase in investor comfort with the space," said Mond.

While GTM Research expects Mosaic and Dividend Finance to continue to securitize as a way to raise capital (in addition to selling portfolios of loans), most other lenders choose to finance themselves exclusively through portfolio sales, which can generate higher returns than securitization.

***

Solar research subscribers can access the report here. Not yet a subscriber? Learn more here.