Residential solar PV has had a remarkable decade. From 2010-2020, more than 2 million residential solar panels have been installed in the U.S., supported in large part by the 30 percent federal Investment Tax Credit. But the ITC is of course only one part of the equation.

Though the ITC has provided foundational support to the solar industry across all segments, several states have gone further to provide additional in-state incentives for homeowners to purchase solar. Ranging from the early days of the California Solar Initiative to New York’s Megawatt Block program and the establishment of numerous lucrative SREC markets in the Northeast, these regions have benefited tremendously from supportive state-level solar policy and incentives.

Unsurprisingly, this also means that to date, most growth in residential solar has been concentrated in a handful of state markets that offered additional incentives. Looking at cumulative residential installations, a mere five states account for a full two-thirds of national installed capacity — all concentrated in the aforementioned regions that provided state-level policy support for rooftop solar in the last decade.

In particular, the “Big Five” have historically been California, Arizona, New York, New Jersey, and Massachusetts.

But while the growth story of the last decade has centered around federal and state-level policy support subsidizing rooftop retrofit solar, the next decade of solar growth will have much more diverse demand drivers as the ITC steps down and legacy markets reach higher saturation levels.

With the decade ending, we're beginning to see glimpses of the future composition of the solar market.

New states rise up the solar rankings

With the Q3 2019 solar data released in last week’s U.S. Solar Market Insight report, a notable trend has emerged. For the first time since Wood Mackenzie has collected data, not a single Northeast state market ranked within the top five states for residential installations.

Instead, these legacy markets were supplanted by a handful of newcomers like Florida, Texas and Nevada — states with a markedly different profile than the legacy markets that have driven growth to date.

These markets — and the comparison to legacy markets — are worth examining to better understand the future of residential solar demand over the next decade.

First, unlike the Northeast, these emerging markets do not have robust state-wide incentive programs. Further, while these states do allow net metering in some capacity, Texas only has net metering if individual utilities choose to provide it. Meanwhile, Nevada has a net billing mechanism with export credits that are below the full retail rate, leaving Florida as the only one of these three emerging markets with state-wide retail rate net metering policy.

In short, these states are seeing growth despite limited incentives and a less favorable solar policy environment.

Secondly, these states also have much lower electricity rates than legacy Northeast markets, ranging between 12th and 16th lowest retail electricity prices in the U.S. in 2019, according to Wood Mackenzie data. In contrast, three of the five legacy state markets have the first, second, and fourth highest electric utility rates in the country. This is important because rooftop solar needs to be much more cost competitive in these emerging state markets to enable solar adoption, though it bares mentioning that installations costs are lower in these markets as well primarily due to cheaper labor.

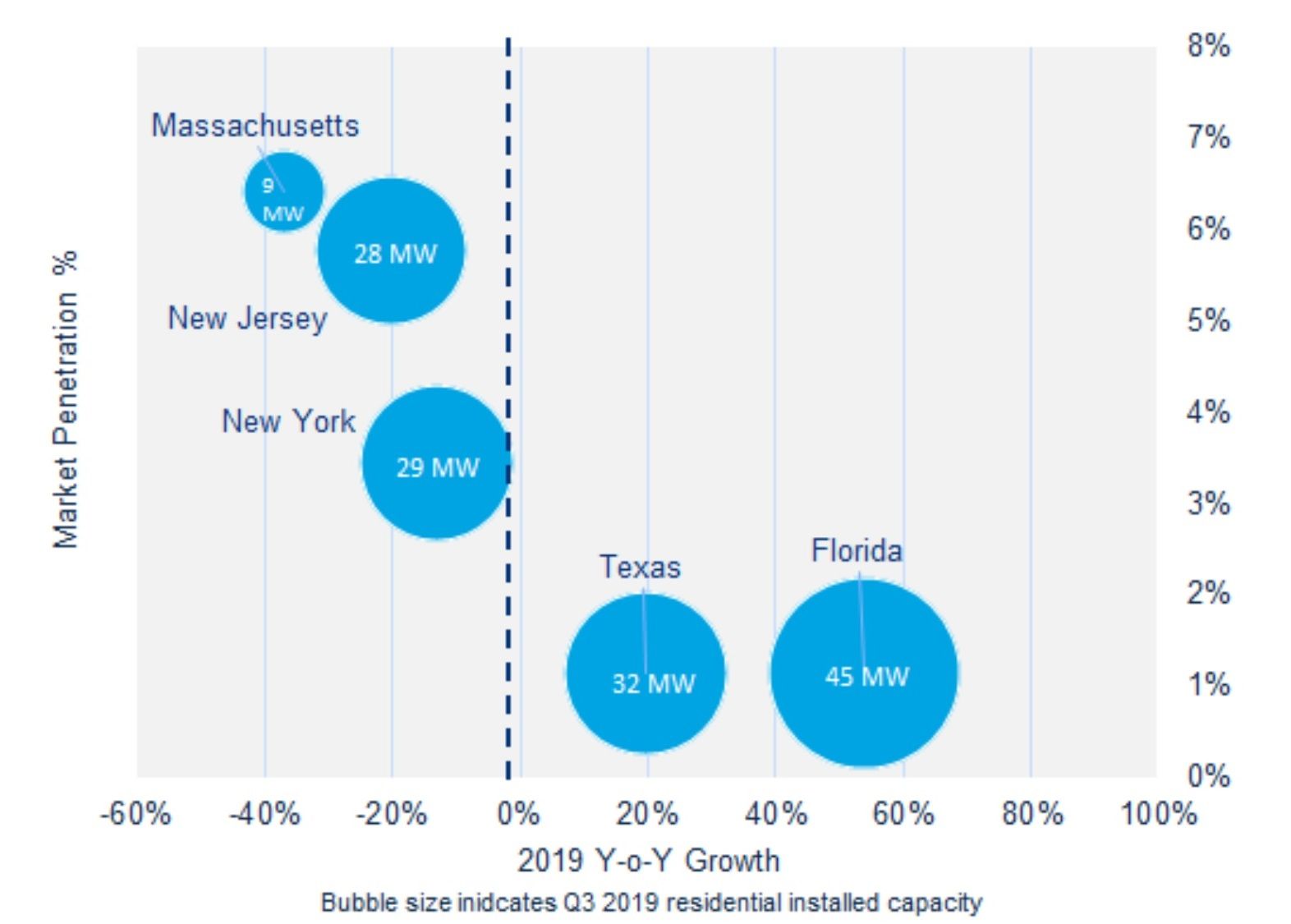

Finally, these emerging markets have very low penetration levels relative to their Northeast elders. For instance, nearly 17 percent of the total addressable market in California has adopted solar, while the remaining legacy markets range from 3.5-10.5 percent market penetration. By comparison, Florida and Texas are at 1 percent market penetration. Accordingly, emerging states have plenty of headroom to support long-term growth. Under our forecasts, neither state is expected to surpass 6 percent market penetration by 2030.

Market Penetration and Annual Growth of Select Residential Solar Markets

Low penetration in key growth markets

If the last decade of solar growth was driven by early adopter states with high retail rates and robust incentives, the next decade of growth is going to be driven by a new set of states where the increasing economic competitiveness of solar as an unsubsidized resource is the driving force behind demand. And with low market penetration across key emerging markets, there is plenty of headroom for growth.

This is not to say that legacy state markets are going anywhere. While the Northeast will cease to grow as quickly as it has in previous years, the region will still provide steady installation volumes throughout the next decade. But saturation levels appear to have reached their limit given current system pricing trends — and this is not expected to change for quite some time.

Even with an average 4 percent annual system cost decline for the next five years, the phase-down of the ITC from 2020-2022 means that — barring disruptive innovation to the customer acquisition process — pricing to customers will remain stagnant into the mid-2020s. Combine that with the fact that all legacy markets are either undergoing a dramatic shift to their incentive programs and/or their bill crediting mechanism, and legacy markets face substantial — though not insurmountable — headwinds over the next few years.

California's home solar mandate

With all that said, it would be a mistake to think that geographic diversification is the only demand driver likely to evolve going into the next decade. In almost serendipitous fashion considering its status as the most significant legacy market, California happens to be leading in both of these trends.

For one, California’s new home solar mandate will kick off the next decade. Going into effect in 2020, the mandate is forecast to drive over one gigawatt of demand over the next five years. To put that into perspective, that’s as much residential solar as Arizona has installed cumulatively. Though no other state has passed a state-wide solar mandate to-date, it would be a game changer to our national residential solar projections if another state-wide mandate was passed.

Though we’re still in the early days of ramp-up for mandate compliance, one thing is very clear — new home solar changes the equation for customer acquisition, which remains the highest category in the residential cost stack. While there are many additional hidden costs for developers in the home solar space, new home solar presents a new opportunity to acquire customers by including the purchasing decision in the home buying process. Unsurprisingly, legal mandates provide upside to our forecasts.

Secondly, Public Safety Power Shutoff events (PSPS) are beginning to drive significant demand in California. All of the national installers have increased their marketing copy around PSPS events while local installers have cited a 3-5x increase in solar leads in H2 2019 while also seeing an increase in retrofit energy storage from existing solar customers.

While it's currently unclear if this is a long-term trend, if these events continue it only provides fodder for installers and greater incentive for ratepayers to seek resiliency options such as solar and storage.

Bringing it all back home

Looking to the 2020s, diversification will be the defining feature of residential solar as new geographies beyond the states highlighted here surpass grid parity. But diversification will not end there. If additional states pass new home solar mandates, the way in which solar is sold is set to shift in a monumental way.

Further, if extreme weather events continue to drive consumers toward resiliency options such as solar plus storage as they have in California, a pure economic decision-making process based on payback period may cease to be the primary buying rationale for customers. And in that scenario, there is significant upside opportunity for residential solar.

Amidst all the change however, one thing is clear: residential solar is becoming a mature industry as it enters the new decade.

***

Austin Perea is a senior solar analyst at Wood Mackenzie Power & Renewables. Download the free research insight on the U.S. distributed solar market in the 2020s.