Amid a historic economic contraction, renewable resources grew to account for one-fifth of all electricity produced in the U.S. in 2020, according to newly released data from Bloomberg New Energy Finance and the Business Council for Sustainable Energy, a coalition of clean energy, utility and natural gas companies.

Record-breaking wind and solar additions brought zero-carbon resources — which also include hydro and nuclear — to 40 percent of the 2020 electricity mix in the United States. Analysts heralded the growth as an indicator of these sectors’ resilience, in contrast to continued declines in coal power and the first drop in natural-gas demand since the Great Recession in 2009.

“It was a year of records but also resilience,” said Ethan Zindler, head of Americas research at BloombergNEF at an event highlighting the report. “I’ll be candid in saying [that] about halfway through the year, things looked pretty dire.”

In the coronavirus pandemic’s early months, the renewables industry braced for significant pain and dealt with some. As the virus spread in Asia, plants paused production, stalling supply chains. In the U.S., shutdown orders hampered construction and sales for a time. Overall, the renewables industry lost more than 67,000 jobs from February through December, according to nonpartisan business group Environmental Entrepreneurs, which has tracked the industry’s job losses through the pandemic.

In the end, those struggles did not mute overall growth. BloombergNEF's data showed a record year for U.S. solar installations, landing at 16.5 gigawatts. The previous record, set in 2016, was 14.4 gigawatts. Wood Mackenzie, another energy consultancy, puts the figure even higher for solar installations in 2020, at more than 19 gigawatts of solar added (different analysis firms log a project at different points in their development).

The same record trend holds for wind; the industry added more than 17 gigawatts, according to BloombergNEF. Taken together, renewable additions grew 11 percent from the year prior.

Other data points, though, indicate how difficult it will be to erode the grip that fossil fuels have on the power industry, as President Biden has pledged to do. Though natural-gas demand dipped last year, the resource still accounted for 41 percent of U.S. power generation, more than any other resource and greater than its share in 2019. Only nuclear and coal did not grow their portion of electricity generation in 2020.

Though scientists recognize the need to make deep and immediate cuts to emissions, companies whose bottom lines are defined in part by selling natural gas continue to frame gas and renewables as complementary resources.

“If you love renewables, you have to at least like natural gas,” said Lisa Alexander, senior vice president of corporate affairs and chief sustainability officer at Sempra Energy, which sells natural gas and is the parent company of San Diego Electric & Gas and Southern California Gas Company. “We don’t see it as oppositional. We see it as both systems working in tandem to decarbonize.”

Natural-gas additions have helped the U.S. power sector shed coal capacity, said BloombergNEF’s Zindler. But as the next phase of decarbonizing electricity begins, it remains “an open question” how swiftly power providers can and will be willing to cut gas in favor of clean renewables, and if the sector can decarbonize within the timeframe Biden has laid out.

“I think it’s going to be one of the great, interesting challenges of the next four years and beyond,” said Zindler.

Changes that helped foster the growth of renewables in recent years mean the U.S. power sector has already met targets under the Clean Power Plan, according to the Carbon Tax Center, though that Obama administration-era policy was never enforced. Further cuts will require more ambitious policy.

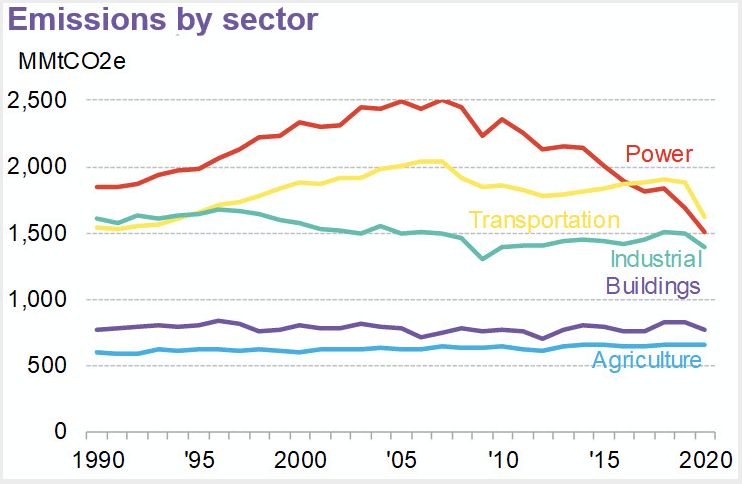

A steep decline in power-sector emissions helped overall U.S. emissions take a 9 percent nosedive in 2020, putting the country much closer to its Paris Agreement commitment to reduce economywide greenhouse gas emissions 26 to 28 percent below 2005 levels by 2025. Zindler called it a “remarkable drop.”

But the lasting impacts are expected to be fleeting because those cuts were wrought by a seriously crippled economy and a struggling society, rather than comprehensive energy or climate policy. Power also makes up only a portion of emissions. The transportation sector, which saw a similarly large drop in emissions that analysts also expect to rebound, accounts for a majority of U.S. emissions.

Source: BloombergNEF

Analysts are eager to see how significantly and quickly the economy rallies in 2021, and what that will mean for renewable growth as well as carbon emissions.

“It’s going to be hard to see which of these changes will be permanent, but some will clearly have long-term implications,” said Zindler.